What Factors Affect My Monthly Loan Payment?

There are a number of factors that can significantly influence the outcome of your monthly payment when getting a loan for a commercial vehicle. Having a deep understanding of each factor can help you to plan better and potentially lower your costs.

- Credit Score: The creditworthiness of you or your LLC plays a key role in determining your interest rates and, ultimately, the total cost of the vehicle.

- Down Payment: The larger your down payment, the less you’ll need to finance, which means lower payments. Average down payments typically range from 5% to 30%.

- Amortization Schedule: Refers to how often you’ll make payments and the loan term. In most cases, longer schedules result in a higher total amount paid due to interest accrual.

- Vehicle Price: The cost of the vehicle has a direct impact on your loan terms. Higher prices typically lead to higher monthly payments.

- Trade-In Value: Sometimes you can reduce the total amount financed and lower your payments by trading in a used truck.

- Rebates and Incentives: Manufacturer rebates, dealership incentives, and even government incentive programs can reduce the cost of a new or used truck, which is especially true for certain eco-friendly trucks (i.e., electric or hybrid vehicles).

- Loan Term: For the most part, longer terms reduce monthly payments but increase the total interest paid.

- Warranties: Warranties add to costs in the short term, but long-term, they can provide massive savings on truck repairs.

Whether you’re just starting your trucking business or you’re a veteran owner-operator, knowing what to expect when buying a semi-truck can help you to make savvy business decisions that positively impact your short- and long-term financial prospects.

Formula Used

Monthly Payment = [r*PV] / [1 – (1 + r)^-n]

In this formula:

- r is the monthly interest rate (annual rate / 12).

- PV is the present value or principal of the loan (price – down payment).

- n is the number of periods or payments.

- To calculate the monthly payment, you multiply the monthly interest rate by the principal and divide that by the difference of one and the result of one plus the monthly interest rate raised to the power of the negative number of payments.

Examples

| Truck Price (dollars) | Down Payment (dollars) | Sales Tax Rate (%) | Interest Rate (Annual, %) | Financing Period (months) | Estimated Monthly Payment (dollars) |

|---|---|---|---|---|---|

| 120000 | 20000 | 7.5 | 5.0 | 60 | 1909.58 |

| 150000 | 30000 | 8.25 | 6.0 | 72 | 1911.38 |

Frequently asked questions (FAQs)

What is the financing period?

The financing period is the total duration over which the loan will be repaid, typically expressed in months (i.e., 12 to 60+ months).

Where can I find the interest rate?

The interest rate is typically provided by your lender and is the cost of borrowing the principal loan amount. It can be variable or fixed, but it’s always expressed as a percentage.

How often should I use this calculator?

It’s recommended to use this calculator whenever you are planning to get a loan for a semi-truck. It can help you understand how much you can afford to borrow and what your monthly payments will be.

Do you have other calculators for the trucking industry?

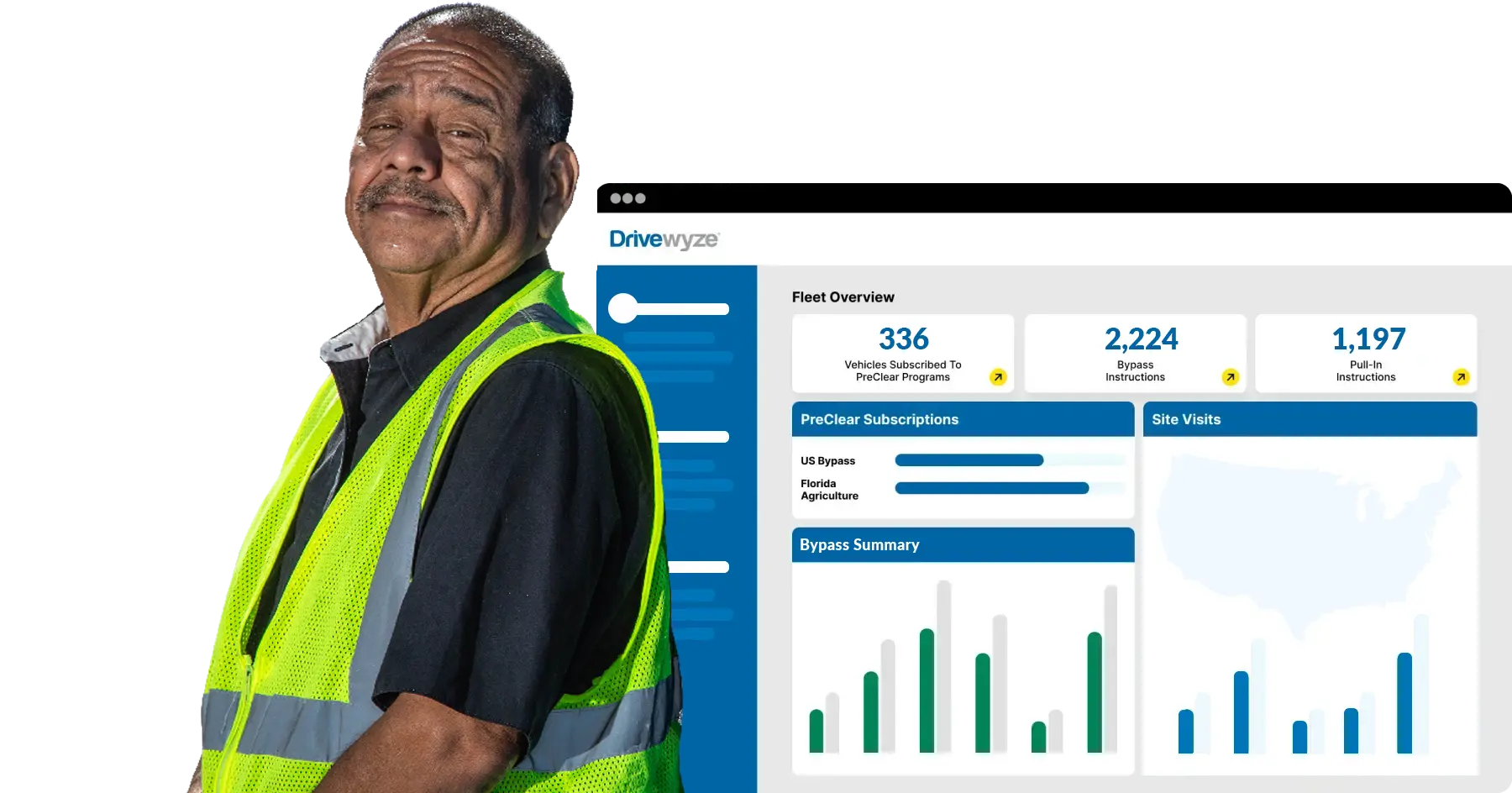

At Drivewyze, we’re dedicated to bringing efficiency and safety to the trucking industry while enhancing the driver and operator experience. Check out a few of our most popular trucking calculators below:

- Truck Depreciation Calculator

- Semi-Truck Gear Ratio & Speed Calculator

- Truck Driver Per Diem Calculator

- Semi-Truck Maximum Payload & Towing Capacity Calculator

- Trucker Salary Calculator

- Semi-Truck Tire Pressure Calculator

- Semi-Truck Axle Weight Calculator

- Semi-Truck Fuel Cost Calculator

Want to learn more? Check out our Resource Center Today!

Find out how CalArk cut costs and improved fleet efficiency with Drivewyze.

Discover the strategies and technology that helped optimize their operations, and how you can do the same.

Ready to Get Started?

Learn how Drivewyze can improve commercial transportation safety and efficiency