Formula Used

Annual Depreciation = (Purchase Price − Salvage Value) / Years in Use

In this formula:

- Purchase Price: The initial cost of the semi-truck.

- Salvage Value: The estimated value of the semi-truck at the end of its useful life.

- Years in Use: The number of years the semi-truck has been or will be in use.

This formula uses the straight-line depreciation method, which assumes that the semi-truck loses value evenly over time. While simple, it doesn’t account for real-world factors like mileage, maintenance, and market conditions. Alternative methods like declining balance or units of production depreciation can offer more precise financial reporting, but for basic estimates, this method is widely used.

More accurate estimates can be made using other approaches such as residual value analysis, condition-based adjustments, or partial-year depreciation methods.

Examples of Truck Depreciation

Suppose you purchase a new semi-truck for $100,000 and expect a salvage value of $20,000 after 5 years of use. Using the straight-line formula:

- Annual Depreciation = (100,000 − 20,000) / 5

- Annual Depreciation = 80,000 / 5

- Annual Depreciation = $16,000 per year

This means the truck depreciates by $16,000 each year, reaching a book value of $20,000 after 5 years. For context, luxury cars like a BMW 7 Series can depreciate as much as 61.8% in five years, or about $14,488 per year.

Frequently asked questions (FAQs)

What factors influence semi-truck depreciation?

Whether it’s within the first year of a new car purchase or you’re wondering the market value of your work truck after several years, many factors can influence the rate of depreciation, including the truck’s age, mileage, maintenance history, market demand for used trucks, and the make and model. Additionally, accidents or significant repairs can also affect depreciation rates.

How is semi-truck depreciation calculated?

Semi-truck depreciation can be calculated using various methods, but one common approach is the straight-line method. To calculate annual depreciation, subtract the estimated salvage value of the truck from its purchase price and then divide by the number of years the truck is expected to be in use.

Can depreciation be minimized or managed effectively?

While depreciation is inevitable, it can be managed. Regular maintenance, proper care, and keeping detailed records of a truck’s history can help maintain its value. Additionally, choosing trucks with better resale values and staying informed about market trends can assist in minimizing depreciation’s financial impact. Leasing instead of purchasing can also be a strategy to manage depreciation, as lease terms often align with a truck’s useful life.

What limits does the IRS place on truck depreciation?

The IRS provides specific remedies for truck depreciation deductions, including the Section 179 deduction and bonus depreciation. In 2024, you can deduct up to $28,900 for trucks that weigh more than 6,000 lbs, depending on the circumstances. Lighter trucks typically have lower limits and the depreciation is spread across three or five years.

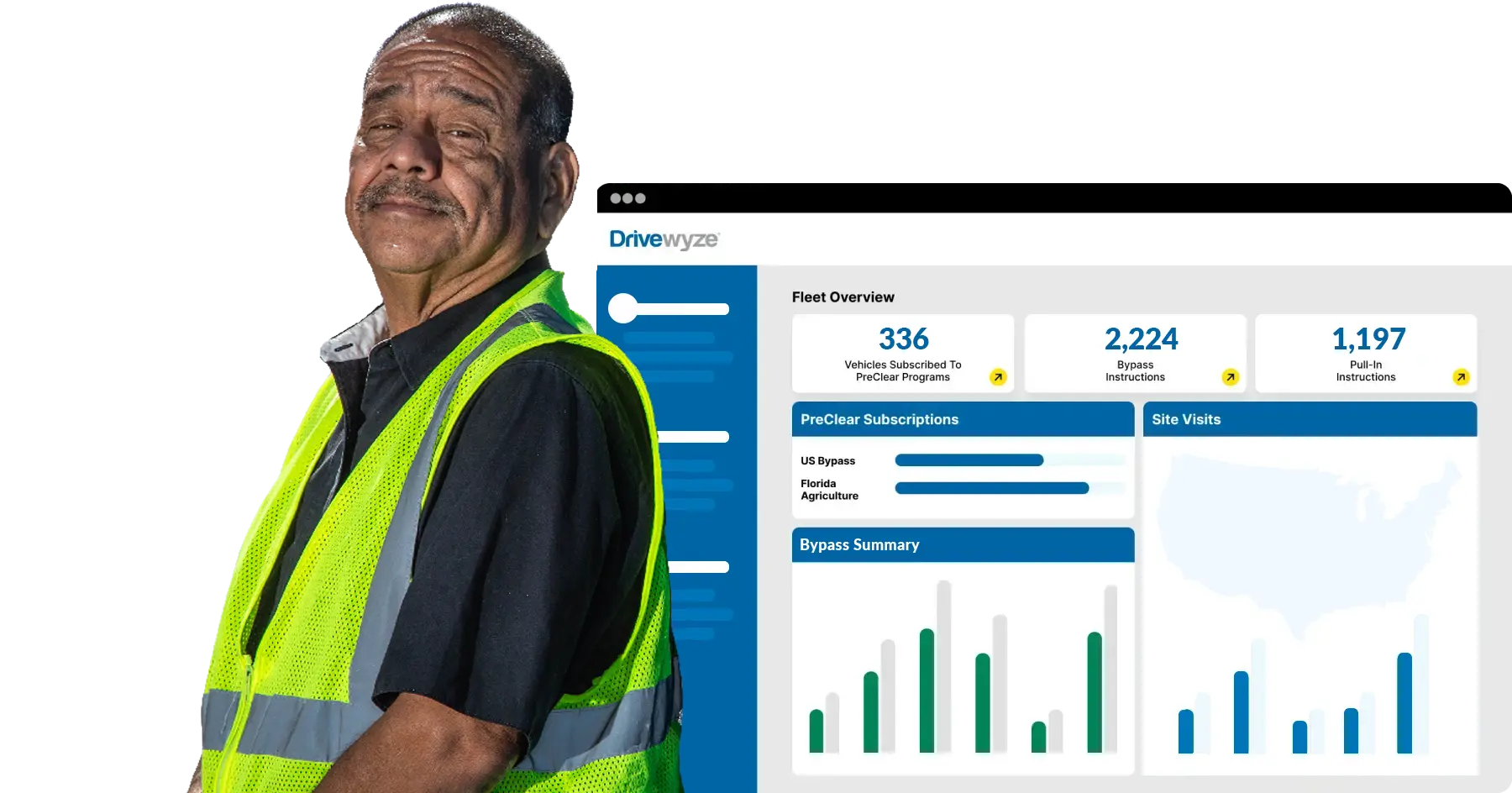

The trucking pros at Drivewyze are dedicated to making commercial trucking safer, more efficient, and more accessible for truckers and fleet managers everywhere. That’s why we provide free resources that can help your business thrive. Check out a few our best trucking calculators below:

- Semi-Truck Gear Ratio & Speed Calculator

- Truck Driver Per Diem Calculator

- Semi-Truck Loan Calculator

- Trucker Salary Calculator

- Semi-Truck Tire Pressure Calculator

- Semi-Truck Axle Weight Calculator

- Semi-Truck Fuel Cost Calculator

- Semi-Truck Maximum Payload & Towing Capacity Calculator

Want to learn more? Check out our Resource Center today!

The Tandet Transportation Group: Boosting Bypass Opportunities with Drivewyze

Discover how Tandet Transportation enhanced their fleet’s efficiency and safety by leveraging Drivewyze’s innovative technology.

Ready to Get Started?

Learn how Drivewyze can improve commercial transportation safety and efficiency