From carrier classifications to relevant agencies and emerging issues, here’s what every trucking professional should know about the industry.

Trucking is a fundamental part of the backbone of North American society. The industry not only contributes significantly to the United States economy, but also enables consumers, businesses, governments, and supply chains alike to conduct essential everyday activities.

In the US, trucking employs 8.4 million people, not including self-employed workers, and is responsible for more of the country’s gross domestic product (GDP) than any other freight mode. The industry is also growing. The Freight Transportation Services Index (TSI) indicates that trucking is expanding faster than other transportation methods, including rail and waterway.1

If you’re new to trucking—or simply want to refresh your knowledge as a fleet manager or other professional—reviewing key aspects of the industry can be helpful. This article provides a comprehensive introductory resource, covering:

- The history of trucking in the US

- Trucking contributions to the economy

- How freight carriers are classified

- People, agencies, and organizations relevant to the industry

- Emerging industry challenges

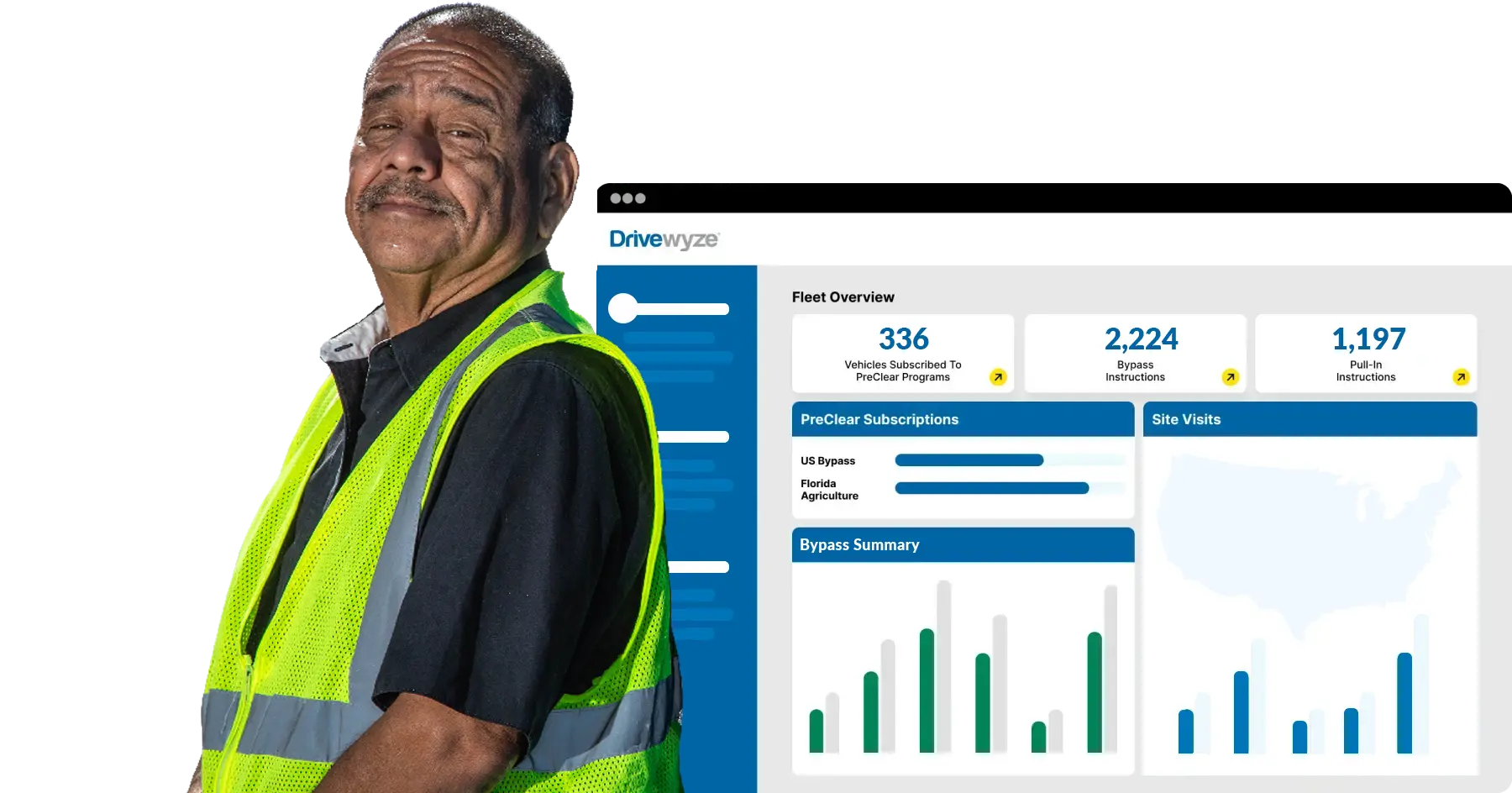

Who is Drivewyze?

Drivewyze builds hardware and software solutions to improve fleet and highway safety. With 20+ years of experience working with fleets of all sizes, as well as owner-operators, safety solution providers, and state safety enforcement agencies, Drivewyze shares an in-depth understanding of the industry’s history, operational structures, and issues.

A Brief History of the Trucking Industry

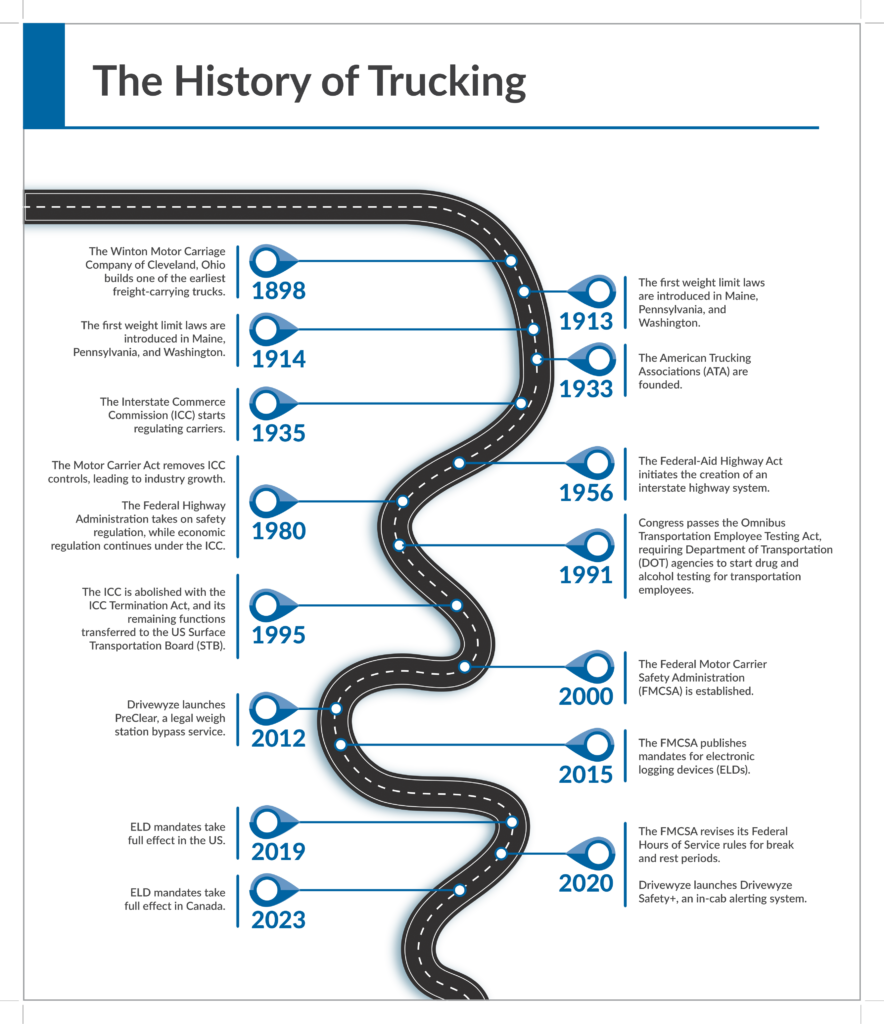

Commercial Trucking Is Born

Some of the first cargo-carrying trucks were created by the Winton Motor Carriage Company of Cleveland, Ohio in 1898. These trucks were early iterations of the modern semi-trailer truck, using an attached trailer to transport other motor vehicles. These trucks gained popularity among other freight-carrying companies, and by 1913, the first commercial weight limit laws were introduced by several states, later expanding nationwide in 1933.

The outbreak of World War I (WWI) in 1914 prompted the widespread adoption of pneumatic tires as military vehicles needed to carry heavier loads at faster speeds. In the US, this advancement served as a much-needed workaround for a railway system that was congested from supporting the war effort.

The American Trucking Associations (ATA) Are Established

As trucking became more common, competition with railroads increased in the post-WWI decade. In 1933, the American Highway Freight Association joined forces with the Federated Trucking Associations of America to establish the American Trucking Associations (ATA) in 1933.

The ATA’s primary goal was to create an official code of fair competition between trucking and other freight modes. Its formation also aligned with President Roosevelt’s call for a post-depression plan to stimulate the economy through US industries. In 1935, the Motor Carrier Act replaced the ATA’s existing competition code, allowing the Interstate Commerce Commission (ICC) to start regulating the carriers.

Deregulation Drives Industry Expansion

In the latter half of the 20th century, trucking exploded due to two main government initiatives. First, the Federal-Aid Highway Act in 1956 initiated the construction of a new interstate highway system, helping carriers expand their reach as a coast-to-coast freight mode. Then, in 1980, the Motor Carrier Act signaled the end of ICC economic regulations. This gave carriers more freedom to grow, reducing operating costs while providing more flexibility for trucking innovations. Deregulation also resulted in higher competition and fewer unions.

Trucking Safety Becomes a Focal Point

As deregulation triggered rapid industry growth in the 1980s and 1990s, safety regulations evolved to reduce the number and severity of crashes. For example, all states adopted a maximum gross weight limit of 80,000 lbs on interstate highways in 1981. In the 1990s, truckers faced new Commercial Driver’s License and drug and alcohol testing requirements. New technologies were also regulated, such as anti-lock mechanisms in new trucks with air brakes. During this era, safety in the trucking industry was regulated by the Federal Highway Administration’s Office of Motor Carriers.

The Federal Motor Carrier Safety Administration (FMCSA) replaced the Office of Motor Carriers in 2000 to further improve and regulate commercial motor vehicle safety. It has introduced several mandates in the years since, such as increased truck and driver inspections and carrier safety audits, as well as changes to driver hours of service (HOS) rules. In 2015, the FMCSA published mandates for electronic logging devices (ELDs) in commercial trucks, which track driver and vehicle information in real-time. These ELD regulations came into full effect in 2019 in the US and 2023 in Canada. Since the turn of the century, companies like Drivewyze have also emerged with technologies, such as in-cab alerting systems, to help carriers keep fleets safer.

The industry has come a long way since its early days from primarily transporting other vehicles pre-WWI. Today’s trucking companies serve North America by hauling essential goods, enabling everyday services like mail delivery and garbage collection, building roads and other critical infrastructure, and transporting defense services.

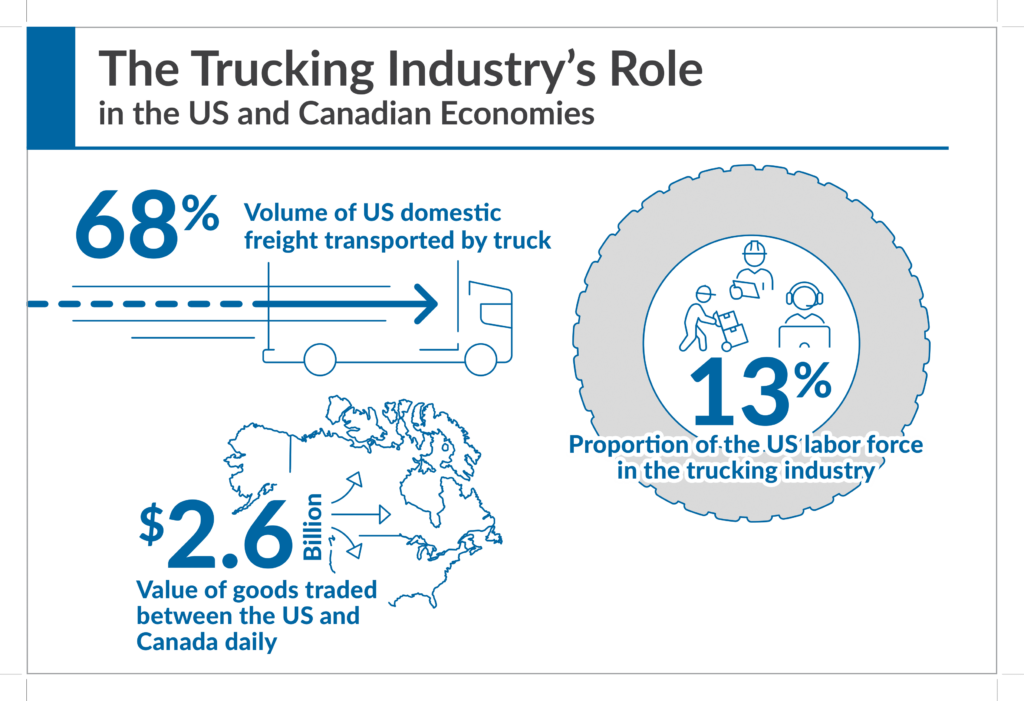

The Trucking Industry’s Role in the US and Canadian Economies

Trucking is central to the economy in both the US and Canada, where most goods are transported by commercial vehicles. Both countries share the longest international border in the world, which includes 120 land-based ports of entry, and sees $2.6 billion worth of goods exchanged each day. Trucking is essential to facilitating this trade, contributing to a significant portion of each country’s GDP.

In the US, the trucking industry:

- Transported over 12 billion tons of shipments domestically, accounting for about 68% of total domestic shipment tonnage. This is expected to exceed 17.5 billion tons by 2050.5

- Contributes the largest amount of any other freight transportation mode to the US GDP, at $389.3 billion.1

- Accounted for 13% of the total US labor force and almost a quarter of employment in the transportation and warehousing sectors in 2022.1

- Includes 13.9 million registered single-unit and combination trucks in the US, 5% of all registered motor vehicles.

- Is responsible for 71.5% of the goods shipped to Canada.6

Trucking plays a similarly significant role in Canada. According to the Library of Parliament, carriers supply 3.6% of the country’s GDP and 5.2% of its workforce.6 Commercial trucks carry out nearly a third of Canada’s transportation and warehousing activities.6

Understanding How Freight Carriers Are Classified

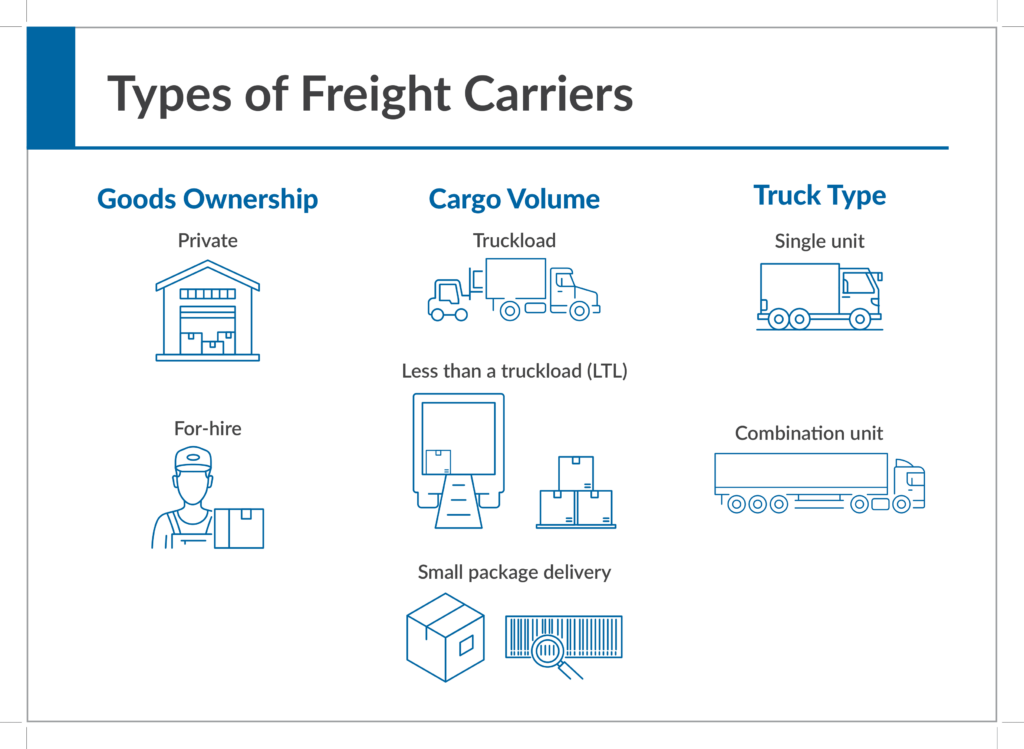

These statistics shed light on the industry’s economic contributions as a whole—but there’s plenty of variation in how commercial trucking companies operate. There are three main ways that carriers are classified: Whether they own the goods they carry, how large their loads are, and the types of trucks they use. If you’re new to the industry, it’s useful to understand these classifications, especially if you’re managing fleet operations or coordinating shipments.

- Goods Ownership

Fleets are often classified as either private carriers or for-hire carriers. Private carriers are typically large companies, such as Coca-Cola or Walmart, that operate fleets and transport their own goods. For-hire carriers are trucking companies that transport goods on behalf of other businesses and people.

- Cargo Volume

When it comes to cargo volume, carriers may fall into one of three categories:

- Truckload carriers transport single-commodity loads from one shipper to one destination. These carriers are usually decentralized with few terminals and routes that frequently change. While truckload carriers often hire their own drivers, they also use individual owner-operators who lease themselves to the carrier.

- Less-than-truckload (LTL) carriers transport multi-commodity truckloads for several different shippers. This is more economical for delivering small loads over longer distances. LTL carriers tend to have many terminals with regular routes and schedules. Their trucks typically start at a terminal where small local delivery vehicles unload goods from various businesses. The freight is then consolidated into one large truck and transported to another terminal. From here, the goods are dispersed back onto local delivery trucks to reach their final destination.

- Small package delivery carriers function similarly to LTL companies. However, they serve individual consumers and retail distributors with small deliveries. Some well-known small package delivery carriers include UPS, DHL, and FedEx.

- Truck Type and Configuration

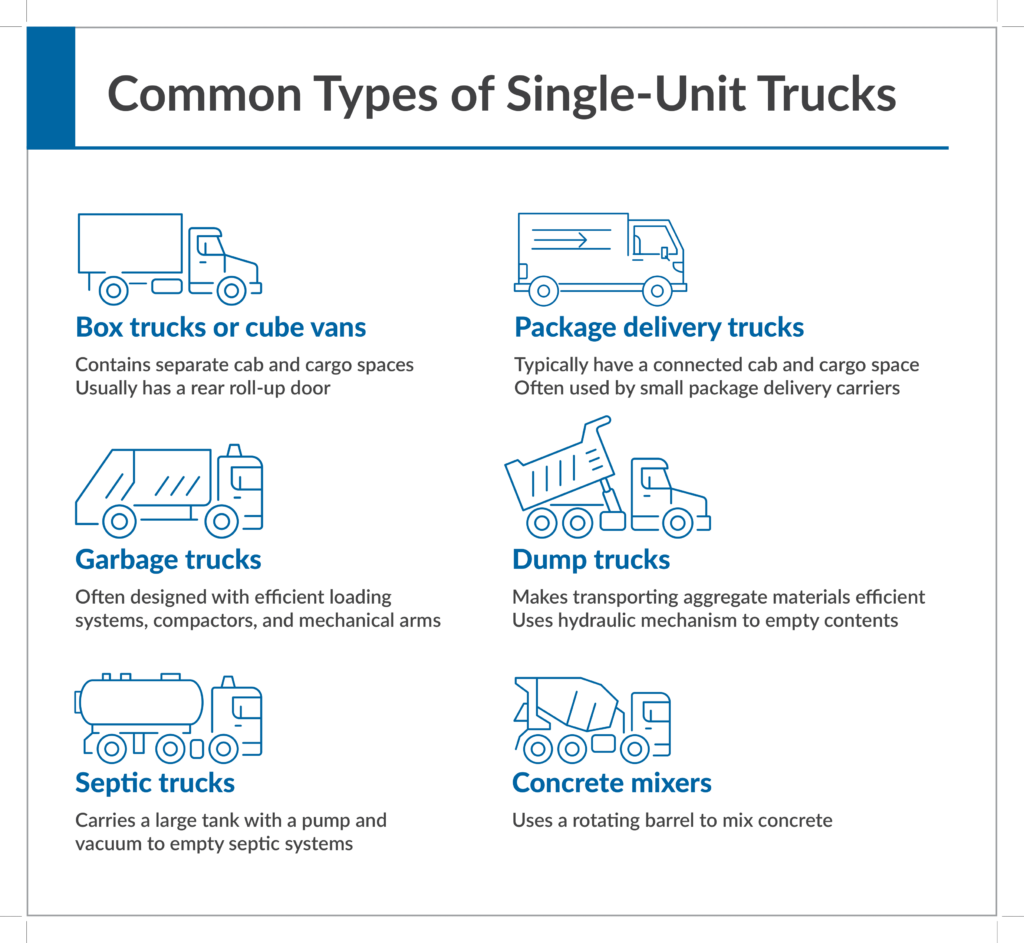

Lastly, fleets can be characterized by the types of vehicles that they use. Carriers that do smaller, local deliveries use single-unit trucks. These are straight trucks, which means that the cab and storage container are built on one chassis. Small package delivery trucks, such as those used by delivery companies, as well as garbage trucks and utility trucks, are examples of single-unit configurations.

| Truck Ownership Vs. Leasing Not all carriers own their trucks. Leasing commercial trucks is a common practice, as it can help reduce operating costs. This is because leasing gives carriers more flexibility to expand or condense their fleet size based on market demand. It can also enable carriers to better manage maintenance and equipment costs. Some well-known leasing companies include Ryder, Penske, Xtra, and TIP Group. |

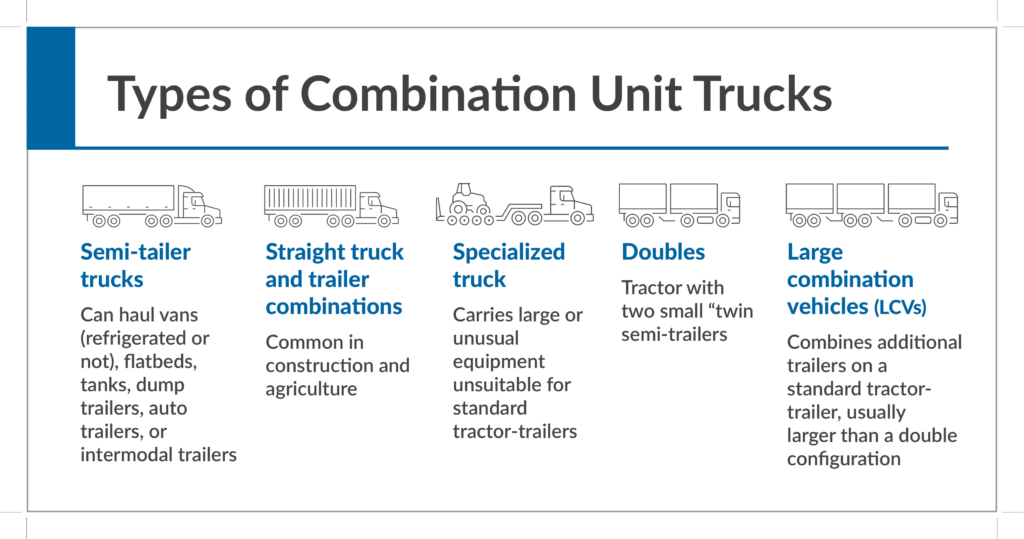

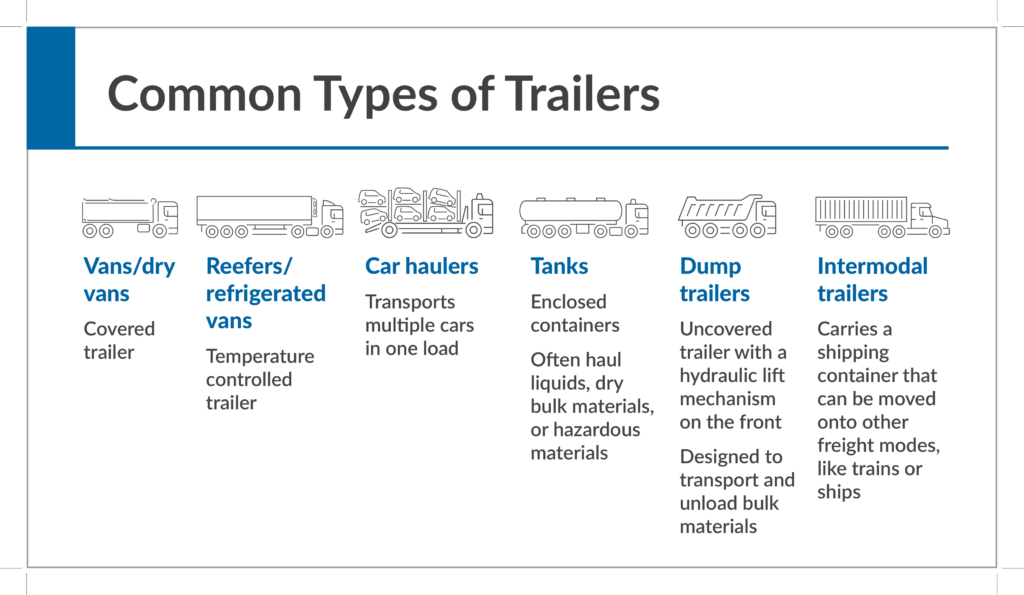

Carriers that haul larger interstate shipments use combination unit trucks or tractors. These have a tractor, which contains the cab and engine, and a separate trailer that pivots around corners on a fifth wheel. Vehicles that are designed with a pivot point to turn more sharply are called articulated vehicles. These include combination unit trucks as well as other commercial vehicles, like articulated buses.

Combination unit tractors can have a long nose with the driver’s compartment behind the engine (conventional) or a snub nose with the compartment above it (cabover). Semi-trailers have back wheels only, relying on the tractor to support its front weight in transit, while a full trailer has both front and rear wheels.

People and Organizations in the Trucking Industry

Considering the role of trucking in North America—and its sizable economic contributions—it’s no surprise that the industry is a major employer requiring a diversity of professional skill sets. Various government organizations are also crucial in regulating industry practices such as safety, operational permitting, and sustainability.

Fleet Professionals

According to the Bureau of Transportation Statistics, there were around 3.53 million truck drivers in the US in 2022.1 Over half of them operate heavy tractor-trailer configurations, while a third drive light delivery trucks. Drivers must hold a commercial driver’s license (CDL) when operating a vehicle over 26,000 lbs or when carrying hazardous materials. A CDL may have endorsements depending on the load type or vehicle configuration being operated.

| Common CDL Endorsements |

| Long combination vehicle (LCV) endorsement Tank-carrying endorsement Hazardous material endorsement Passenger vehicle endorsement |

While drivers make up the majority of people employed in the trucking industry, carriers also depend on several other roles: Mechanics, managers, supervisors, warehouse workers, dockers, dispatchers, freight forwarders, and owner-operators. In 2022, the Bureau of Transportation Statistics estimated that there were 271,720 commercial vehicle mechanics and diesel engine specialists, 206,370 dispatchers, and 848,240 shipping, receiving, and traffic clerks in the US.1

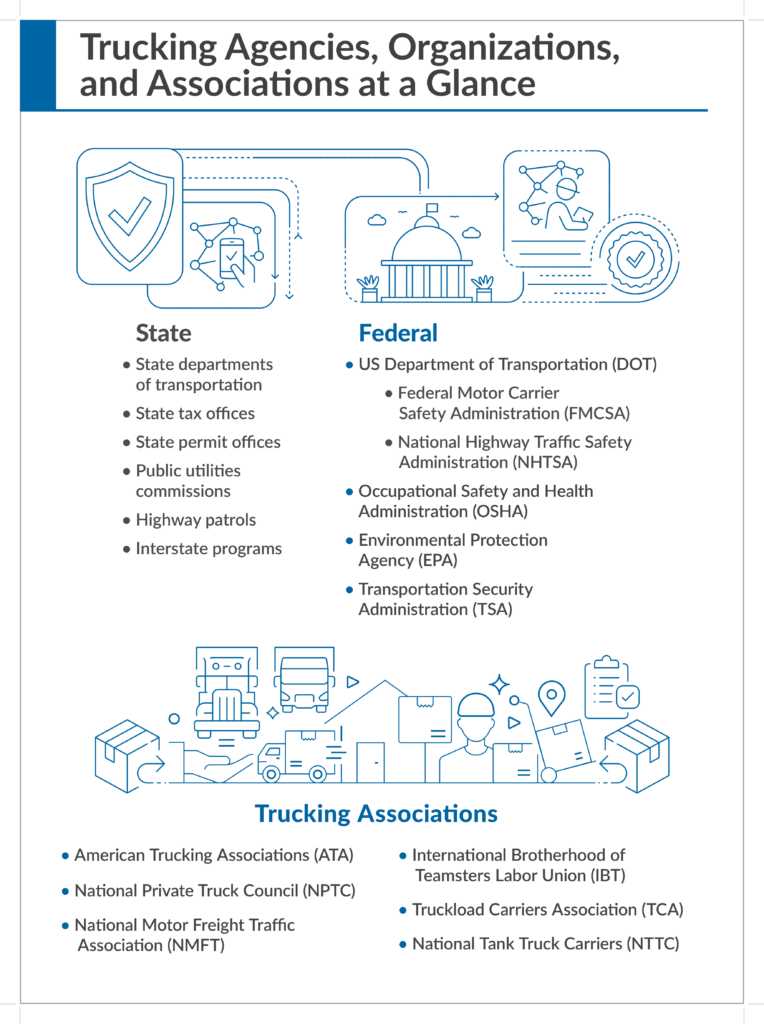

Relevant Agencies and Organizations

| Helpful Links: Learn more about Federal Highway Administration regulations by state. Access a comprehensive summary of FMCSA regulations. |

Carriers must adhere to a variety of regulations enforced by state and federal agencies:

State Organizations

State departments of transportation design, plan, build, operate, and maintain state projects for all freight modes. Additionally, each state department has a permit office, from which carriers obtain operating permits. For example, state offices issue permits for oversized and overweight vehicles.

Carriers must also observe state tax office requirements, especially if they do interstate shipments. There are two interstate programs to ensure carriers pay fuel taxes and register vehicles per their operating area: The International Fuel Tax Agreement (IFTA) and the International Registration Plan (IRP).

Public utilities commissions (PUCs) regulate state utilities, including water, wastewater, electricity, telecommunications, and gas. PUCs typically have regulations for motor carriers. For instance, PUCs can dictate allowable state routes for hazardous materials. Lastly, truck drivers frequently interact with state highway patrol, which enforces state and interstate traffic laws and commercial vehicle regulations. State officers also perform safety inspections for commercial trucks.

| Tip: State Trucking Regulations Remember that weight, vehicle, and driver safety regulations are managed by different enforcement agencies—such as the DOT, PUC, or highway patrol—depending on the state. Make sure to research the relevant agencies when assessing regulations by state. |

Federal Organizations

The US Department of Transportation (DOT) is responsible for keeping US transportation systems safe, efficient, sustainable, and equitable. The DOT is the main federal governing body relevant to the trucking industry, overseeing the Federal Motor Carrier Safety Administration (FMCSA) and the National Highway Traffic Safety Administration (NHTSA).

The FMCSA aims to reduce commercial motor vehicle incidents by enforcing safety regulations, raising safety awareness, and improving commercial vehicle safety systems and technology. The NHTSA helps keep roadways safer for all drivers, not just truckers, through state and local government partnerships. Other relevant federal organizations include:

- The Occupational Safety and Health Administration (OSHA). Carriers must comply with OSHA standards to keep trucking professionals healthy and safe on the job. The OSHA has recordkeeping and general industry regulations specifically for the trucking industry.

- The Environmental Protection Agency (EPA). EPA regulations include commercial vehicle standards for greenhouse gas emissions and air pollution.

- The Transportation Security Administration (TSA). The TSA was established in 2001 to enable safe freedom of movement throughout US transportation systems. Drivers who enter TSA-controlled areas, like airports, must obtain a TSA certification—for example, if they need to transfer cargo from a truck to a commercial plane. Carriers can also request TSA training support for surface transportation-related risks.

| Trucking Associations Trucking associations serve as an intermediary between carriers and government agencies, helping advocate for fleets and operators while conducting research to guide policymakers. Some of the biggest associations include: American Trucking Associations (ATA): The largest national trade association in the trucking industry. The ATA supports members with business operations and advises government agencies on trucking policies. National Private Truck Council (NPTC): Established in 1939 to support private fleet operators and vendor partners. The Council provides access to trucking resources, such as networking and certifications, and advocates for trucking legislation. National Motor Freight Traffic Association (NMFTA): Advances the interests of motor carriers through education, industry research, and legislative advocacy. The NMFTA represents LTL, for-hire interstate, and intrastate carriers. International Brotherhood of Teamsters Labor Union (IBT): Enforces contracts for freight drivers and warehouse workers in the US and Canada. There are 358 IBT affiliates in the US and 22 in Canada. Truckload Carriers Association (TCA): Founded in 1938 to represent dry van, refrigerated, flatbed, tanker, and intermodal container carriers in North America. National Tank Truck Carriers (NTTC): Champions for the tank truck carriers’ safety through education and advocacy. |

Key Industry Challenges

The trucking industry has largely recovered from the pandemic, with freight volumes expected to rise significantly in the coming years. However, emerging regulations and market uncertainty mean that forward-thinking carriers are adopting innovative technologies and safety strategies to stay resilient. Here are some of the key challenges carriers face today.

Driver Hiring and Retention

According to the American Transportation Research Institute (ATRI), the average annualized driver turnover rate for large fleets exceeded 50% in 2022. This means that half of the commercial drivers that were hired in 2022 left to pursue opportunities with another carrier or industry within a year. This can increase operating expenses, with industry publications estimating a new hire to cost anywhere from $6,000 to $12,000.

A competitive hiring market means that many carriers are rethinking driver salaries and benefits to attract and retain employees. Sophisticated in-cab technologies, such as weigh station bypass services or safety alerting systems, can also appeal to drivers by making the job less stressful and more efficient.

Fleet Efficiency and Sustainability

In the US, transportation contributes to almost a third of greenhouse gas emissions, while trucks account for three-quarters of freight transportation energy consumption.9 EPA regulations are set to enforce stricter standards for heavy-duty vehicle emissions by 2027.9 Alongside regulations, rising fuel costs and operational costs per mile—which increased by 21.3% over 202110—are forcing carriers to reconsider fleet efficiency.

Fleets can improve sustainability and address new EPA regulations through idle-reduction solutions. For example, services such as Drivewyze PreClear enable drivers to legally bypass weigh stations, promoting more efficient fleets and less idling time. EPA-reviewed calculations have shown that Drivewyze PreClear can save carriers 0.4 gallons of fuel per bypass. Additionally, Drivewyze e-Inspection automates some of the inspection process, improving fleet efficiency when bypasses aren’t authorized. Fleets can recoup up to 30 minutes of drive time per inspection with this service.

Fleet Safety

Fleets are under pressure to invest in comprehensive safety programs, which not only can help attract and retain drivers but also lower incident-related costs. However, only a minority of fleets use advanced safety technologies (25%), safety benchmarking (14%), or safety culture (12%), even though these are effective ways to improve driver safety and minimize damages.

Proactive carriers are promoting safer driving behaviors and lowering incident rates by investing in smart safety technologies. These include in-cab alerting systems such as Drivewyze Safety+, which notifies drivers when they are nearing hazards like severe weather or performing unsafe driving practices.

Carriers have used Drivewyze Safety+ to improve their Compliance, Safety, and Accountability (CSA) scores, which measure a carrier’s overall safety performance. It also has a positive impact on a carrier’s Inspection Selection System (ISS) score, which is used by roadside commercial vehicle enforcement officers when inspecting trucks. Together, sufficient ISS and CSA scores enable:

- Reduced accident frequency, severity, and claims costs.

- Lower insurance costs and premiums.

- Fewer DOT audits.

- Improved industry reputation, leading to better customer and employee retention.

- Greater eligibility for weigh station bypass services for further cost savings.

Insurance Costs

Insurance premiums are a persistent challenge for carriers. According to the American Transportation Research Institute, premiums increased by 47% between 2010 and 2020. On average, auto liability premiums were 8.8 cents per mile in 2022, and are expected to continue rising through 2023 as a result of higher costs and poor insurance industry performance in 2022.10

This issue is closely linked to fleet safety. Carriers that leverage advanced safety technologies, apply proactive safety training, and have a strategic approach to safety culture can encourage safer driving performance and avoid accidents. This not only prevents insurance costs from multiplying but also shows insurance companies that carriers are performing due diligence to prevent future incidents.

| “Even with the number of accidents going down, the cost is going up. The insurance carriers want to see what you have done, not only with the occurrences that you have… [but] what you are doing to prevent future occurrences.” —Brian Runnels, Vice President of Safety, Reliance Partners |

Looking Forward

The trucking industry plays a major economic role in North America and makes the daily activities of consumers, businesses, and governments possible. Fleets vary in size and operational structure, but some core issues are present across most carriers: Driver retention, fleet efficiency and safety, and rising operational and insurance costs.

Understanding these challenges is crucial to navigating the industry as a new fleet manager or other professional. Forward-thinking fleets can address current issues by investing in idle reduction technologies like Drivewyze PreClear and Drivewyze e-Inspection, as well as advanced safety alerting systems such as Drivewyze Safety+. These Drivewyze solutions are cost-effective ways for fleet operations and management teams to:

- Develop a safety culture that promotes safer driving behaviors, fewer incidents, and lower insurance premiums.

- Improve fleet efficiency while reducing fuel consumption.

- Attract and retain skilled drivers, especially those who value fleet safety and efficiency.

These outcomes will support fleets as the trucking industry continues to grow and develop amid economic uncertainty, evolving regulations, and a changing workforce.

Ready to Get Started?

Learn how Drivewyze can improve commercial transportation safety and efficiency